Nestle

Background:

- 2000 brands – Allen’s, Uncle Tobys, NesCafe

- Available 191 countries

- Over 150 years old

- Founded in 1866 and is headquartered in Vevey, Switzerland.

- Started in 1867 by Henri Nestle when he created an infant cereal that saved the life of a child

- Milo cereal made in 1934 in Australia

- 1952 Maggi soup was launched

Their mission: enhancing quality of life, inspiring healthier living, act legally and honestly

Their ambitions: help families lead healthier lives, striving for zero environmental impact in our operations, improve livelihood in communities

- Since some of the world’s largest chocolate companies like Mars, Nestlé and Hershey’s base their pricing strategies on their ability to sell large quantities of chocolate at low prices. However, these inexpensive costs come with other expenses as harmful chemicals like lindane and menthyl bromide are found in the pesticides used to maintain cocoa crops9

- While Mars, Nestlé and Hershey have all denied supporting unfair practices and child slavery from any of their suppliers, it has been found that approximately 75% of the chocolate consumed in the United States is sourced from the Ivory Coast, a nation known for child slavery issues.

Found a way to make natural pink chocolate – has a slight berry taste

Kit Kat (Nestle) Marketing Mix

Product:

- KitKat – big blocks, rectangle bars, 3 part bar (caramel, cookies n’ cream etc)

- Product innovation with special flavours available in different markets get people interested in trying and collecting them all

Place: Chocolate aisle (big blocks) or the check out aisle

Price: $1.69, On special, down $0.30-0.60

Promotion:

- Lots of print and web ads all using their slogan ‘Have a break, have a Kit Kat’ with visuals of a broken Kit Kat.

- The memorable and consistent slogan has cemented Kit Kat in consumers minds

- Instagram @kitkat

- Youtube

- Website – Nestle site very business like and generic as has to be suitable for all Nestles brands. Individual Kit Kat site really on brand

- On special, down $0.30-0.60

Competition:

- Cadbury (moro, mars, bounty etc.)

- Whittakers

- Artesian chocolate such as Wellinhton Chocolate Factory

- Premium Brands such as Lindt, & Guylain

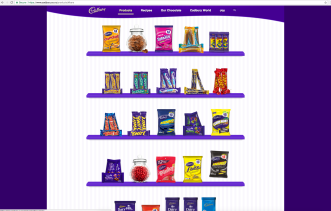

Moro Marketing Mix (Cadbury)

Background:

- Moro around since 1967

- 1884 Mr Hudson opened factory

- 1930 Mr Hudson teamed with Cadbury to make first block of dairy milk

- 2006 Moro Gold developed

- Cadbury in a new partnership with Fairtrade to support the roll out of Cocoa Life to Cadbury Dairy Milk products in 2018.

Product:

- Nougat, caramel and milk chocolate

- Available in a 60g bar, 85g twin pack and 12 piece share pack

- Packaging:

- Energetic, masculine and tough looking appearance

- slab sans serif heading

- Heading looks like its bursting out the packet as it increases in side

- Movement lines behind

- Black wrapper with bright yellow and red – almost like colours of caution sign, bright, energetic

- “A fistful of nougat..” slogan also emphasises the tough energetic side

- Older slogan “get more go’ connects Moro with strenuous activities – physical or mental

- Energetic, masculine and tough looking appearance

Place: chocolate aisle, check out aisle, majority of supermarkets, convenience stores, petrol stations, vending machines etc.

Price: $1.60

Promotion:

- On Cadbury’s website the Moro bar blurb comes across as aggressive, strong, masculine, & tough.

- “Cadbury Moro: Only the bravest chocolatiers dare enter The Moro chamber in our factory. To make a Moro bar, first you must wrestle and whip the nougat into submission, then win a tug of war with the caramel, before you seal it all in a chunky cage of Cadbury milk chocolate. That’s why a Moro is packed full with more delicious satisfaction than any other bar.”

- Check out alise, specials – 4 for $5 or on discount

- Cadbury World Dunedin

- Website

- Social Media

- Video adverts

- A glass and a half full of Joy – selling hapiness not just chocolate

This ad portrays Moro as very kiwi, humorous and energetic bar. The character shown is humorously shown as extremely manly with the fake mullet, handlebar moustache and the vest.

This is a really old Moro ad but it still communicates the original values very clearly – sporty, energetic, active – to give energy.

Competition

- Main competitors are Mars and Milky Way with similar nouget and caramel product

- Cadbury (moro, mars, bounty etc.)

- Whittakers

- Artesian chocolate such as Wellinhton Chocolate Factory

- Premium Brands such as Lindt, & Guylain

Targeting:

- People involved, or wish they were, in physical activities and sports

- Wanting an energy boost (for work, study, exercise)

- Men

Macro trends:

Economic concerns

- High cocoa bean prices, as it is hard to raise prices to consumers, margins are squeezed

- Global boundaries shifting “As our global awareness builds, our economies become more intertwined, political trends spread, and media keep us all connected.”

- The connected world has led consumers of all ages to become more knowledgeable of other cultures – desiring different cuisines

General chocolate trends

- “Cargill says indulgent, premium, healthy, and sustainable and clean, will be the key trends driving the chocolate and cocoa industry next year.”3

- Trend towards more premium products: more dark chocolate, origin label chocolate, bean variety with extended conching. Emphasis on provenance and origin (not necessarily just the chocolate such as Belgian Chocolate but in the ingredients such as Himalayan Salt)

- Handmade and artisanal chocolate becoming more popular – shift towards simple pleasures/handmade/craft feel

- Consumers seek comfort from modernised updates of age-old formulations, flavours and formats

- Recipes are going back to basics but with the added benefit of natural energy-boosting ingredients, antioxidants, vitamins and protein supplements

Environmental

- Shift to plant based diets (Vegan/dairy free): Due to environmental and animal welfare concerns increasing, milk alternatives increasing such as coconut milk

- “Almond, cashew and coconut milks will continue to grow as dairy alternatives, while the number of vegetarian, vegan and gluten-free options is predicted to reach new heights”

- The preference for natural, simple and flexible diets will drive further expansion of vegetarian, vegan and other plant-focused formulations

- As plant-based milks, meat alternatives and vegan offerings have rapidly moved into the mainstream, consumers are looking for innovative options to take the inherent benefits of plants into their daily lives

- Environmental cost of chocolate has spurred certified chocolate, pressure for companies to use fair trade sourced cocoa

- Rainforest alliance label

- The focus of sustainability zeros in on eliminating food waste

Health

- Natural and healthier ingredients

- Healthy food and drink are not “luxuries”

- Regulatory pressure increases focus on fruits and vegetables; nutrition rich vegetables, fruits and seeds being rediscovered; more marketing of fruit and vegetables’ natural health attributes

- People are looking for increasingly real ingredients. Use of plant extracts and fruits and vegetables to naturally colour products is booming

- Focus on ingredients: hormone free, GMO free and similar claims are sought out, front of pack origin claims, use of tracking codes on packaging to view where ingredients are sourced from

- Recipes are going back to basics but with the added benefit of natural energy-boosting ingredients, antioxidants, vitamins and protein supplements

- Tropical fruits and flowers were starting to float onto the radar last year, but we’re seeing these flavors combo’d with grains for concepts perceived as “healthier” indulgence

- Floral flavours are popping up and making their way into food and beverages including alcoholic and non-alcoholic beverages and dairy products such as yogurt and ice cream. Flavours in this group include: Blueberry Hibiscus, Orange Blossom Vanilla, Raspberry Lavender.

- Now the goal is “ clean labels”— lists of ingredients consumers can understand and pronounce

- Health in terms of protein

- “The trend for protein is still booming and becoming more mainstream, breaking free from the sports nutrition niche and focusing on satiety rather than sports recovery.”

- The satiety attributes of protein will grow as a marketing platform, more male specific marketing for mainstream protein products, vegetable protein to reach a wider range of consumers

- Protein products such as Clif Bars, Proyo icecream

- Protein high ingredients such as seeds, nuts

- Not necessarily protein amount but protein source

- Fat and sugar

- Sweeter Balance: Sugar is under pressure, although it remains the key ingredient delivering the sweetness and great taste that consumers are looking for

- Increased legislation and regulation due to public debate around fat and sugar

- Nestle reduced the amount of sugar in their foods by 32% between 2000 & 2013

- UK – there has been pressure to remove confectionary items from checkout lines in supermarkets

Top 10 Superfoods for 2017

1. Seeds, like chia and hemp

2. Avocado

3. Nuts, like almonds and walnuts

4. Fermented foods like yogurt

5. Ancient grains

6. Kale

7. Green tea

8. Coconut products

9. Exotic fruits

10. Salmon

Ethical awareness

- Clean Supreme: The rules have been rewritten and clean and clear label is the new global standard. The demand for total transparency now incorporates the entire supply chain, as a clean label positioning becomes more holistic.

- Trend towards certified chocolate due to ethical cost behind producing food

- The two biggest producers in the world—Ivory Coast and Ghana—account for roughly 60-70 percent of the global cocoa supply. Over 2.3 million children were working in cocoa production and 2 million children were involved in hazardous work in cocoa production in Côte d’Ivoire and Ghana combined10

Buying locally sourced

- Concern about ingredient origins

- Whittakers capitalises on this creating iconic kiwi flavours such as L&P and K Bar

- Whittakers puts the products on the front

REFERENCES:

- https://www.nestle.co.nz/aboutus

- https://www.cadbury.co.nz/product/cadbury-moro/

- http://www.confectionerynews.com/Manufacturers/4-key-chocolate-and-cocoa-trends-for-2017-Cargill

- http://www.confectionerynews.com/Markets/10-chocolate-trends-for-2015/(page)/7

- https://www.youtube.com/watch?v=qYKJbE6Sr_g

- http://www.candyindustry.com/articles/86040-cargill-this-years-top-10-trends-for-cocoa-and-chocolate

- http://www.candyindustry.com/articles/86040-cargill-this-years-top-10-trends-for-cocoa-and-chocolate

- https://www.stuff.co.nz/life-style/food-wine/food-news/96540159/chocolate-makers-invent-first-new-colour-in-80-years

- https://epicureandculture.com/facts-about-chocolate-ethics/

- https://www.pastemagazine.com/articles/2017/02/the-truth-behind-the-chocolate-industry-will-leave.html

- https://www.referralcandy.com/blog/kit-kat-marketing-strategy/

- https://www.forbes.com/sites/marymeehan/2016/12/15/the-top-trends-shaping-business-for-2017/#410796ed6a8a

- https://www.foodbev.com/news/macro-trends-growing-now-in-the-food-and-beverage-industry/

- https://www.globalfoodforums.com/food-news-bites/2017-food-trends/

Eden and Mette